How to Issue Credit Memos and Refunds in QuickBooks Desktop

You are accustomed to money going in a certain direction, but sometimes you have to pay your customers. Here are the basics of how to get that done.

Credit Memos

A customer returns an item for which they have already paid, and you have to credit them for their cost. You can deal with the amount of the credit by:

- Retaining the funds in the customer account.

- Issuing a refund.

- Applying it to the next open invoice.

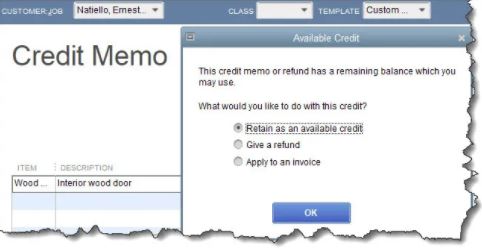

To create a credit memo, click Refunds & Credits on QuickBooks’ home page or open the Customers menu and select Create Credit Memos/Refunds. The Credit Memo window opens. Select the correct Customer:Job. In the line item section of the form, choose the merchandise returned in the Item column and enter a quantity. Repeat the process if more than one item was returned, then click Save & Close. The Available Credit window, pictured above, will open. Click the button in front of the option you want.

Select the first option if the customer wants to retain a credit for future use. Once you click OK and the window closes, the customer will have that credit amount applied their account. You can see this in the Customer Center if you click on Customers in the navigation toolbar (or Customers | Customer Center). You can then either click on the Customers & Jobs tab and scroll down until you can highlight your customer’s record or click on Transactions | Credit Memos.

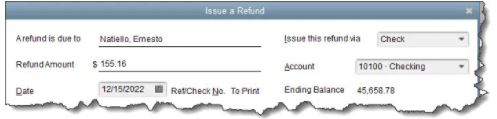

Click on Give a Refund to open the Issue a Refund window. Everything should be auto filled except for the payment method. If you select Cash from the Issue this refund via drop-down list and then pick the correct account from the list that opens, the refund amount will subtract from the account. Select Check and then the Account, and check the box in front of To be printed. That refund will be in the list the next time you open the File menu, then Print Forms | Checks. Choose a credit card and check the box in front of Process credit card refund when saving box to issue a credit card refund automatically.

Tip: Unable to work with credit cards because you do not have a merchant account? We can help you set this up.

If there is an open invoice, the Apply Credit to Invoices window will open, containing a list of unpaid invoices. If there is not already a checkmark in front of the invoice you want to apply it too, click in the first column to create one. QuickBooks will tell you how much credit was applied and whether any remains. When you have checked the screen for accuracy, click Done.

Dealing with Overpayments

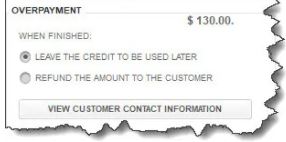

Let’s say a customer is catching up on multiple outstanding invoices and they send you a check for the total but overpay you. Open the Receive Payments window by going to Customers | Receive Payments or clicking Receive Payments on the home page. Select the customer and enter the Payment Amount and Check #. QuickBooks will put a checkmark in front of all the outstanding invoices listed to indicate they have been paid.

In the lower left corner, you will see a section titled Overpayment. The extra amount and your two options for dealing with it appear here. You can either credit the customer or issue a refund. Click the action you want to take, then save the transaction.

Issuing refunds and credits in a timely manner is important and we hope this article helps with that task.