Boost Your Business Knowledge: A Simple Guide to Understanding Owner’s Equity

If you’ve ever looked at your balance sheet and wondered what “owner’s equity” really means—or why it matters—you’re not alone. It’s one of those terms that shows up in financial reports, but it’s rarely explained in plain English.

In simple terms, owner’s equity tells you how much of your business you truly own. Whether you’re just starting out or you’ve been running your business for years, understanding your equity can help you make better decisions, plan for growth, and feel more confident about your financial footing.

Let’s break it down.

What Is Owner’s Equity?

Owner’s equity is what’s left after you subtract what your business owes (liabilities) from what it owns (assets).

Here’s the basic formula:

Assets – Liabilities = Owner’s Equity

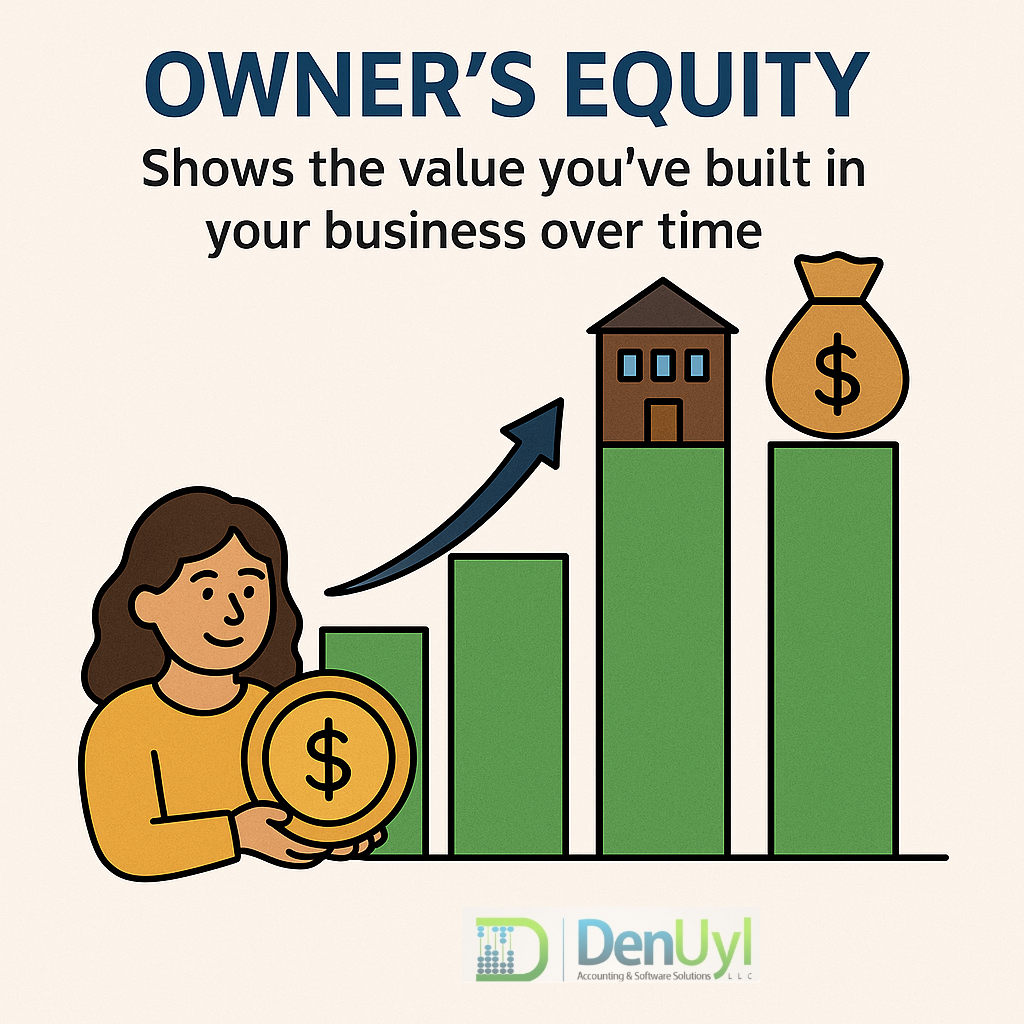

It’s often referred to as your “net worth” in the business. If your equity is growing, that’s a sign your business is gaining value. If it’s shrinking, it might be time to take a closer look at your expenses, debts, or how much you’re pulling out of the business.

The way equity is recorded can vary slightly depending on your business structure:

- Sole proprietorships and partnerships typically call it owner’s equity or partner’s equity.

- Corporations refer to it as shareholders’ equity.

Regardless of the label, the idea is the same—it’s your stake in the business.

What Makes Up Owner’s Equity?

Owner’s equity isn’t just one number. It’s made up of several moving parts that reflect how money flows in and out of your business from the owner’s side. Here are the key components:

- Capital Contributions: Money or assets you personally invest in the business. This increases equity.

- Retained Earnings / Net Income: Profits that stay in the business instead of being paid out. This builds equity over time.

- Draws or Distributions: When you take money out of the business for personal use. This reduces equity.

- Stock and Paid-In Capital (for corporations): This includes funds raised from issuing shares or stock to owners/investors.

Over time, your equity balance tells the story of how much value you’ve built in the business—and how much you’ve taken out.

Why Owner’s Equity Matters

Owner’s equity gives you more than just numbers—it gives you a clear view of your stake in the business and helps guide decisions that shape your future.

Here’s why it matters:

- It shows your true ownership stake. If you sold all your assets and paid off all your debts, your equity is what you’d keep.

- It’s key for securing financing. Lenders and investors often look at equity to gauge how stable and invested you are in your business.

- It helps track your business health. A growing equity balance generally means your business is increasing in value. A declining one might signal trouble ahead.

- It’s important for long-term planning. If you’re thinking about selling your business, bringing in partners, or preparing for retirement, equity plays a central role in those conversations.

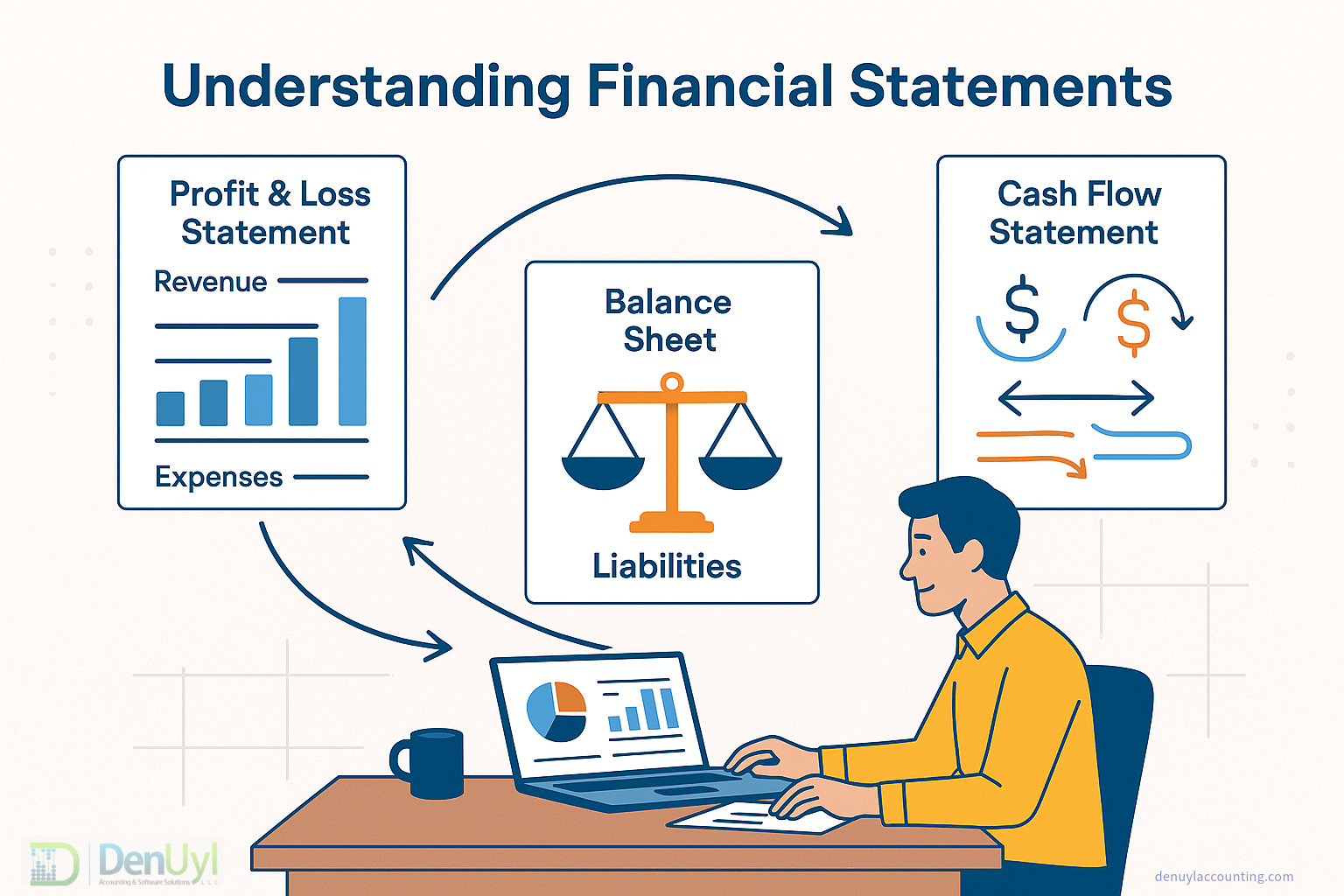

Where to Find It on Your Financial Statements

You’ll typically find owner’s equity on your Balance Sheet, usually toward the bottom under the assets and liabilities sections.

Some common terms you might see in the equity section include:

- Owner’s Equity (or Owner’s Capital)

- Retained Earnings

- Owner Draws or Distributions

- Common Stock / Additional Paid-In Capital (if incorporated)

You’ll also see how equity changes over time based on your net income and owner transactions. For example:

- If your business earns a profit, equity goes up.

- If you withdraw money for personal use, equity goes down.

- If you put more money into the business, equity increases again.

It’s all interconnected, and reviewing your equity balance regularly can help you catch trends early.

Common Mistakes to Watch Out For

Even savvy business owners can make simple mistakes when it comes to equity. Here are a few to avoid:

- Confusing profit with equity: Just because you made a profit doesn’t mean your equity went up—especially if you took that profit out of the business.

- Not recording capital contributions or draws correctly: If you’re adding or removing money, make sure it’s showing up in the right place on your books.

- Ignoring the balance sheet: Many business owners focus only on income and expenses. But your balance sheet tells the bigger story—including how your equity is changing over time.

How to Maintain Strong Owner’s Equity

If you want to build equity in your business (and most owners do), here are a few habits to keep in mind:

- Reinvest profits: Instead of taking out all your earnings, consider leaving some in the business to fund growth.

- Limit unnecessary withdrawals: Every time you take money out of the business, it reduces your remaining share. Try to plan withdrawals with your business’s future in mind.

- Be cautious with borrowing: Carrying a lot of debt can chip away at your ownership in the business. Look closely at how new loans might affect your finances before you commit.

- Keep things in order: Update your records regularly so you can spot equity changes early and avoid issues when it’s time to file taxes.

Final Thought

Owner’s equity shows the value you’ve built in your business over time. It grows with your investments and earnings and shrinks when you take money out or the business takes on debt. Keeping an eye on this balance helps you understand how your efforts are paying off.