Keep More Cash: Better Timing on Receivables and Payables

When we talk about running a healthy business, cash flow doesn’t always get enough attention — specifically how managing receivables and payables plays a significant role in it.

If money isn’t coming in on time, or you’re paying bills too early without a plan, your cash flow can take a hit, even if your business is doing well overall. Let’s look at a few ways to manage both sides more effectively.

Managing Receivables: How to Get Paid Faster

Send Invoices Right Away

Delays in invoicing almost always lead to delays in payment. Once the job is wrapped up or the product has been delivered, go ahead and send the invoice. It sets clear expectations and keeps things moving.

Make Your Payment Terms Clear

Clients should be aware of the exact payment due date, whether it’s “due on receipt” or “net 15,” and adhere to it. It should also be clearly indicated on the invoice.

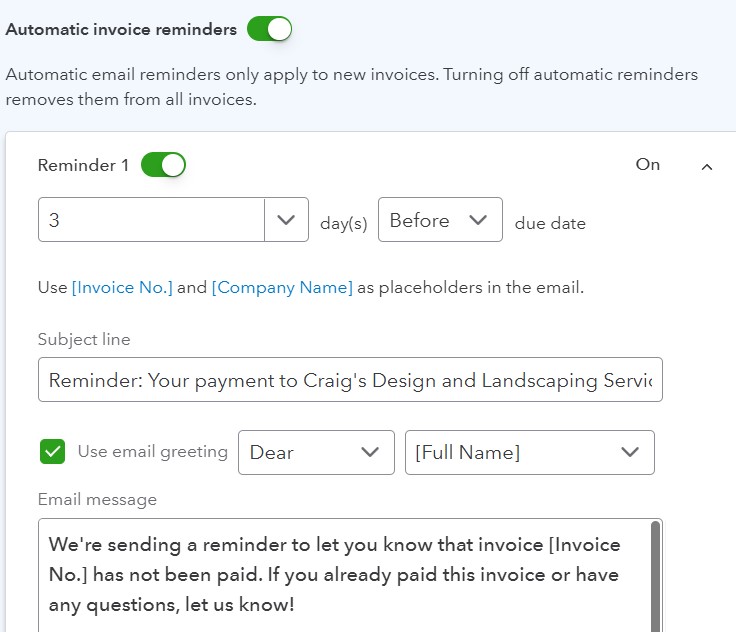

Use Gentle Reminders for Consistent Results

While chasing down customer payments may not be the most enjoyable part of running a business, it is an essential component of the billing process. Sending out a quick email reminder before the due date, along with a follow-up if it goes late, can go a long way. Remember, an accounting system like QuickBooks can automate that process and take one more thing off your plate.

Offer Incentives for Faster Receivables

Offering a small discount, like 2% for early payment, can help encourage quicker turnaround. On the other hand, setting a late fee and enforcing it may help if you consistently deal with delays.

Accounts Payable: Keep Cash in the Business Longer

Use the Full Payment Window Strategically

If a bill isn’t due for 30 days, there’s no need to pay it on day 5—unless there’s a perk like a discount. Keeping that cash on hand a little longer gives you more flexibility to handle other expenses.

Keep Track of Payment Due Dates

It’s easy for a bill to slip through the cracks when things get hectic. A simple checklist or calendar can help you stay organized and keep your vendors happy.

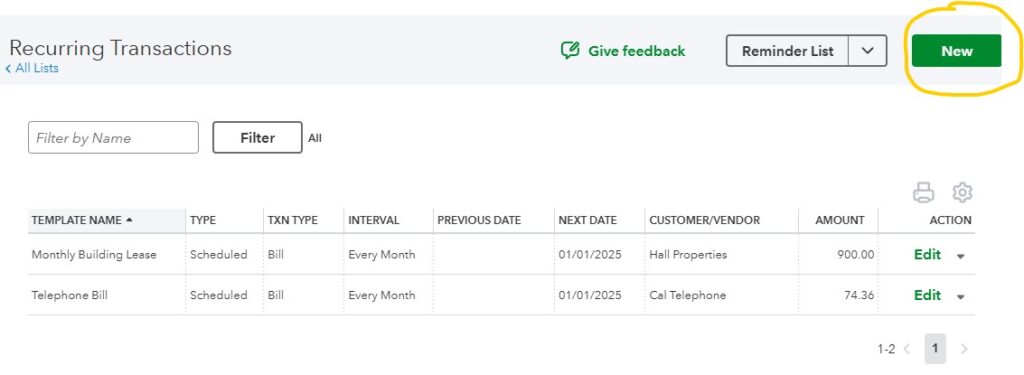

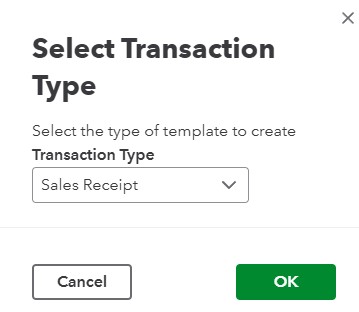

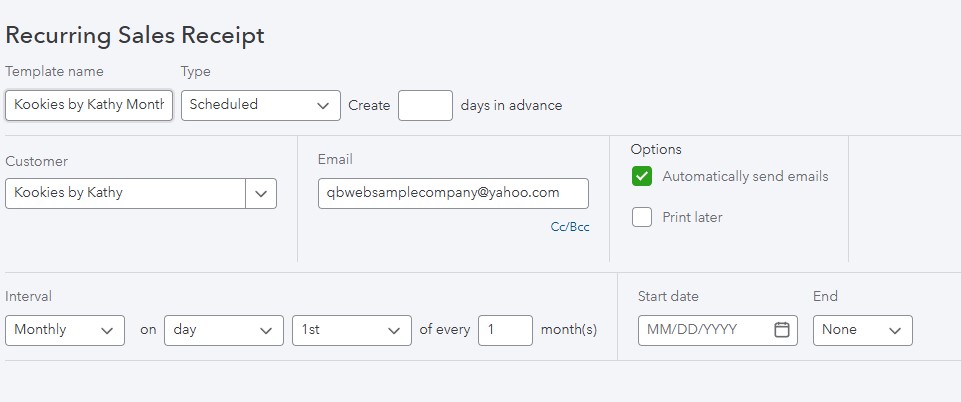

Automate Payables with Accounting Tools

If you’re using something like QuickBooks or a bill payment app, make sure to take advantage of the tools they offer. They make it easier to see what needs to be paid and when, so you’re not digging through emails or spreadsheets to stay organized.

Communicate with Vendors When Cash Flow is Tight

If cash flow is tight, don’t go silent. Reaching out to a vendor before a payment is late can open the door to flexibility, like a payment plan or extended terms.

Why Managing Receivables and Payables Creates a Better Business Rhythm

Good cash flow isn’t about luck—it’s about timing. When you tighten up how and when you get paid, and make smart decisions about when you pay others, your business gains breathing room. It puts you in a better position to plan, grow, and stay steady, even when things get busy.

Start small. Improve one area at a time. You’ll be surprised how much smoother things run when money moves on a schedule that works for you.