How to Set Up a Bookkeeping Cycle in QuickBooks Online

Do you have a regular schedule you follow with your QuickBooks Online work?

Whether you’re a new QuickBooks Online user or a long-time user, having a regular accounting routine can make you more productive and confident that you’re addressing all of your accounting issues.

What Should You Do Every Day?

Even if you don’t have expenses to enter or invoices to process, it’s a good idea to log into

QuickBooks Online every day. If you’ve connected your online bank and credit cards to the

site (which you absolutely should), there will probably be transactions to go over. So after

you’ve taken a look at your Dashboard (especially your Tasks), hover your mouse over

Transactions in the toolbar and click Bank Transactions.

Click Update in the upper right to make sure you’re seeing the most recent transactions. If

you’re doing this every day, it shouldn’t take long to go over the income and expenses that

have been imported since you last logged in.

You should be looking at newly imported transactions daily and completing the fields

provided as comprehensively as possible.

If you don’t know what Match or Record as transfer mean, we should schedule a session

to go over how those work to avoid duplicate transactions in QuickBooks Online.

Every Week

You need to be monitoring your accounts receivable and payables on a weekly basis – at

minimum. There are two ways to do this. You can:

Run reports

- Click Reports in the toolbar and scroll down first to Who owes you. Run Accounts receivable aging summary. QuickBooks will display past-due transactions in several columns (Current, 1-30 days, 31-60 days, 61-90 days, and 91 and over). If you’re keeping up with your receivables, you shouldn’t be seeing numbers in most of the columns, unless you’re in a known collections process.

- Scroll down to What you owe and run Accounts payable aging summary. This works like the aging receivables report. Again, you shouldn’t be seeing much activity here unless you’re in a payment dispute with a vendor.

- You can also run the Open Invoices report to quickly see the Due date and Open balance entries here. Ditto the Unpaid Bills report.

Consult the All Sales page

Hover your mouse over Sales in the toolbar and click All Sales. The colored bars and

numbers at the top of the page show you the status of your sales. Click the orange bar in

the middle to see a list of overdue invoices. If there are any, you can set a Send

Reminder by clicking the corresponding down arrow in the Action column. While you’re

there, look at estimates and unbilled income and take any action needed.

Every Two Weeks (or more often, depending on product volume) If you sell products and track inventory in QuickBooks Online, you should keep a close eye on your stock to see if you need to:

- Reorder,

- Bring in a larger supply because something is selling well, or,

- Discount or discontinue a product because it’s not selling.

Click Reports in the toolbar and run Product/Service List under Sales and Customers

and look at the Quantity on Hand column.

Every Month

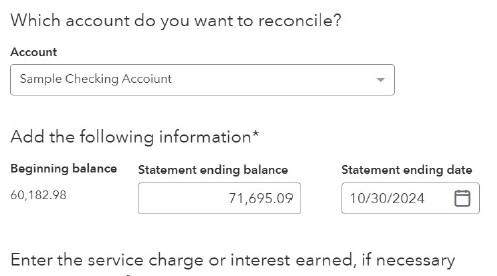

Reconcile your accounts (Transactions | Reconcile)

It’s really important that you reconcile your accounts every month.

No one likes to do this, but it’s way easier to do regular reconciliations than it is to have to

go back several months to track down a problem. If you’ve never done this in QuickBooks

Online, it works similarly to how you used to reconcile your accounts by comparing a bank

statement and your paper checkbook register. Only you’re comparing your bank or credit

card statements to your accounts in QuickBooks Online. Before you start, make sure

you’ve matched and categorized all of your downloaded transactions.

Run a Profit and Loss report for the last month

Click Reports in the toolbar and click Profit and Loss under Business Overview. Did

you make a profit last month?

Every Quarter

If you’re planning to apply for a loan or looking for an investor, or if you just want a deeper

understanding of how your business is doing, consider having us create and analyze

standard financial reports for you, like the Balance Sheet and Statement of Cash Flows.

Lastly, If you ever have trouble categorizing an expense, select Ask My Accountant as the

Category. If we’re meeting with you once a month, we can run a report on these and help

you categorize them correctly.

Give the above a try, review your results, and adjust the schedule as necessary to ensure all your accounting tasks are completed.