New to QuickBooks? Practice These Activities to Get Familiar with QuickBooks Desktop

Learning any new piece of software can be challenging. Add a complex process like accounting, and you may feel apprehensive about your ability to learn how to use it.

While QuickBooks was designed for small businesses, focusing on forms and keeping the accounting jargon to a minimum, it is important to manage expectations that you might not be able to simply jump into the software and complete your accounting tasks.

Here are some suggestions below that will help you become more familiar and confident in using QuickBooks.

Open a sample file

While you are exploring QuickBooks, it is a good idea to work with a sample file. That way, you can look around and practice without risking compromising your company file. You will be able to see how completed records and transactions should look and try your hand at entering sample data of your own.

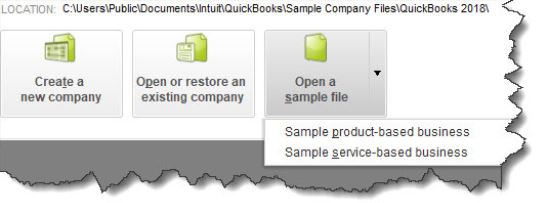

Before you open a sample file, you might need to close your current company. Click on File in the upper left to open that menu, then select Close Company. A window will open that should have your company file in its list. Below that, you will see three boxes containing different options. Click on the down arrow next to Open a sample file, as pictured above (this may look slightly different in your version). Choose the one you want to open and click on it. QuickBooks will load again with that file open. When you are done looking at the sample file, go to File | Close Company again. The No Company Open window should appear again. Click on your company file name and then on Open to return to your own file.

Learn where your lists are

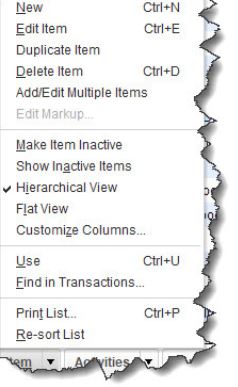

You will be storing a great deal of information in lists. For example, when you create a record for a product or service you sell, it goes into a master list that you can access by opening the Lists menu at the top of the screen and clicking on Item List. You’ll also open the Lists menu when you want to add options to an existing type of list, like Class List (QuickBooks allows you to assign Classes to transactions so you can group related information, like departments or locations for example).

Try a Transaction

Sales receipts and invoices are two sales transactions you will probably want to get familiar with first. QuickBooks comes with templates that resemble these sales forms’ paper counterparts. You simply fill in the blanks by entering data and selecting options from drop-down lists. Open the Customers menu and select Create Invoices. Click the back arrow above Find in the upper left corner to see sample invoices. Then click the right arrow to get back to a blank form and create an invoice by clicking the down arrows in blank fields to see your sample lists.

Tip: If you would like a greater overview of sales receipts and invoices, please reference this article.

Explore Snapshots

Once you start entering records and transactions, you will want to be able to access that information in ways that provide insight on how your company is doing. You will eventually start running reports in QuickBooks, but the software also accomplishes this through its Snapshots. There are three of them, and they all provide these overviews by using data tables and charts. Open the Company menu and click on Company Snapshot, then click the tabs to move between Company, Payments, and Customer. You will learn how QuickBooks provides real-time information about your finances.

Look at the Income Tracker

It is easy to see the status of your invoices (and estimates) in QuickBooks. Open the Customers menu and select Income Tracker. Colored bars at the top of the screen show you what is outstanding and what has been paid. A list of the related transactions appears below these bars.

As we said earlier, QuickBooks can be overwhelming when you first start to use it. We can ease that transition by providing training and consulting on the best way to use QuickBooks.

Tip: We cannot stress enough the importance of having your QuickBooks set up correctly and learning how accounting transactions move through the software. Every entry entered into QuickBooks posts to multiple accounting reports. You want to be able to rely on your reports to make necessary decisions about your business as well as file your annual taxes.