Are You Overlooking Business Liabilities? Learn What You Owe and How to Manage It

When most business owners think about their finances, they tend to focus on what’s coming in (income). But what about what’s going out?

That’s where liabilities come in. And while the word “liability” might sound negative, it’s not necessarily a bad thing. In fact, understanding your liabilities is essential for making informed financial decisions, planning for growth, and keeping your business financially healthy.

What Are Liabilities?

Liabilities represent what your business owes to others. This could be bills to pay, loans to repay, or taxes you haven’t yet filed. Simply put, liabilities are obligations that your business is committed to paying in the future.

Here are some common examples of business liabilities:

- Loans – Bank loans, SBA loans, or lines of credit

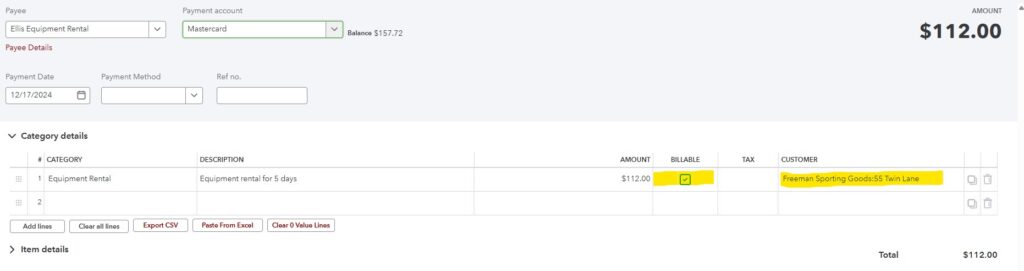

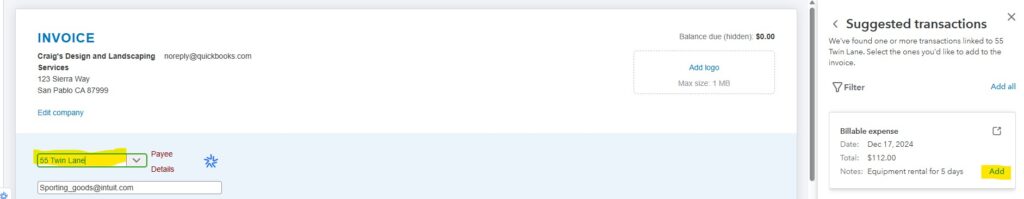

- Accounts Payable – Unpaid vendor or supplier invoices

- Credit Cards – Outstanding balances for business purchases

- Taxes Payable – Payroll, sales, or income taxes you owe

- Wages Payable – Salaries or benefits you haven’t paid yet

To get a better handle on what your business owes, liabilities are broken down into two main categories:

Current Liabilities

These are debts or obligations that are due within one year. They affect your short-term cash flow and day-to-day operations.

Examples:

- Unpaid bills (accounts payable)

- Payroll taxes

- Monthly loan or lease payments

- Credit card balances

Non-Current Liabilities

These are long-term debts or commitments due after one year.

Examples:

- Multi-year business loans

- Equipment leases

- Business vehicle loan

Why Business Liabilities Matter

Paying attention to what you owe is just as important as tracking what you earn. Here’s why:

- Helps manage cash flow – Knowing when payments are due keeps you from running short unexpectedly.

- Guides smarter spending – Avoid overspending when you’re already committed to debt payments.

- Builds lender confidence – Clean, well-managed liabilities show you’re financially responsible.

- Affects your business value – Liabilities reduce your equity—the true value of your business.

- Prompts early intervention – If debt is rising faster than income, it’s a warning sign to adjust.

Liabilities Are Not Always a Bad Thing

Some liabilities can actually support your growth. For example, borrowing to buy new equipment or expand into a new location might create temporary debt, but that investment can pay off over time.

The key is managing debt wisely, and keeping liabilities in proportion to your business’s ability to repay.

Here are a few liability pitfalls to watch out for:

- Mixing personal and business debt – Always keep these separate for legal and tax reasons.

- Over-relying on credit cards – Easy to swipe, but interest adds up fast.

- Ignoring loan terms – Not all debt is created equal. Some loans come with hidden fees or balloon payments.

- Delaying tax payments – Penalties and interest can grow quickly and hurt cash flow.

How to Stay on Top of Liabilities

- Review your Balance Sheet regularly – It shows exactly what you owe.

- Reconcile accounts payable – Make sure bills are paid on time.

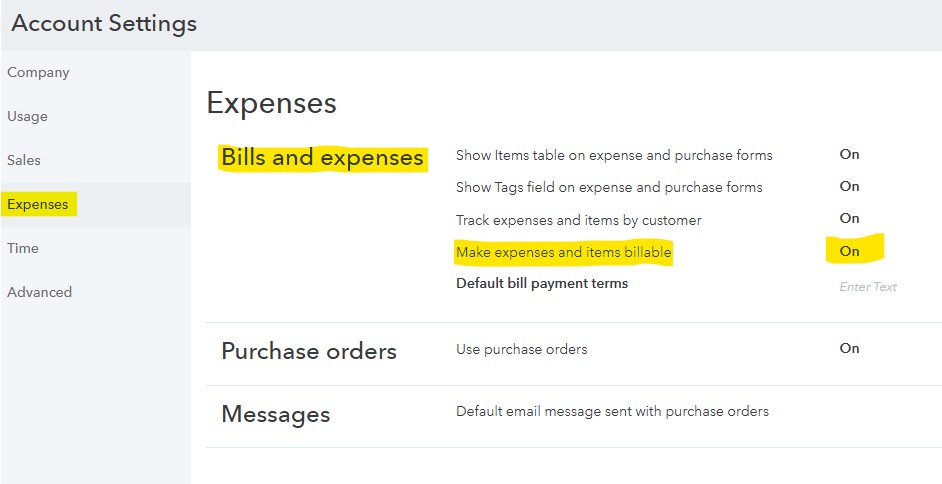

- Use accounting software – Helps you stay organized and track when bills are due.

- Build a cushion – Save a bit extra when business is strong so you’re covered when it’s not.

Final Thoughts

Keeping track of what your business owes doesn’t have to be intimidating. It’s simply part of running a business. Knowing what you owe helps you make smarter decisions, avoid cash flow surprises, and build a more resilient business.

Whether you’re just starting out or growing quickly, make it a habit to look beyond income and focus on the full picture. Because in business, what you owe is just as important as what you earn.