Tracking Mileage in QuickBooks Online

If any part of your work involves driving business miles that can be deducted on your income taxes, you will want to know about a QuickBooks Online feature: mileage tracking. You can record trips either manually or automatically, and the software will calculate your deductions. Here is how it works.

Tracking Trips Manually

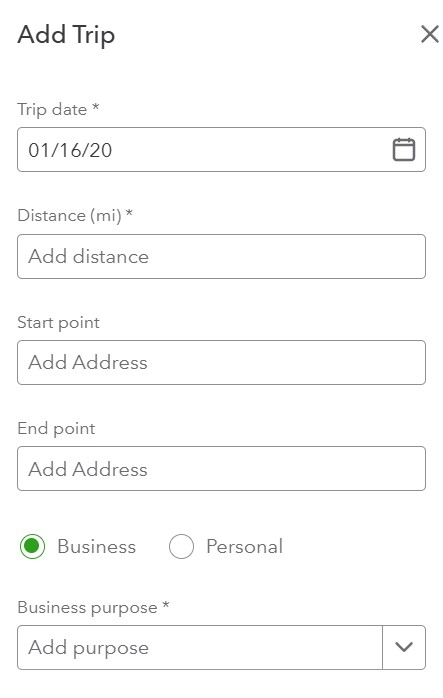

Before you get started, you will want to create a record for the vehicle you will be using. Click Expenses in the navigation toolbar, then choose Mileage. Hover over the green Add trip button on the far right of the screen, and click Manage Vehicles. Click Add vehicle and complete the fields on the screen that opens. Click Save. Back on the main screen, click directly on Add trip. The New trip panel will slide out from the right.

Enter the Trip date, then the number of miles driven (Distance). . Click either the Business or Personal icon and enter a Business purpose from the drop-down menu then select the correct Vehicle if you use more than one. If relevant, click on the Round Trip button and click Save. Your trip will now appear on the main screen with your tax deduction already calculated, as pictured below. Click the More button at the end of the row, and you will be able to Edit your trips and Duplicate them.

Auto-Track Miles

There is another way to track your trips, one that does not involve writing down your odometer readings or mileage. The QuickBooks Online mobile app will automatically track your miles as you drive.

To set this up, open the app and click on the menu lines in the lower right to open the app’s navigation menus. Then click the All tab and scroll until you find the Mileage icon. Auto-tracking is off by default, so click OFF to open the Mileage settings screen. Click the Auto-tracking button to change it from grayed-out to green. In the small window that opens, click Settings to go to the QuickBooks section of your phone’s Settings screen and make these changes:

- Location must be Always On.

- Precise Location must be On.

- Motion & Fitness must be On.

- Background App Refresh must be On.

- Cellular Data must be On.

Close this screen and return to the QuickBooks Online app’s main Mileage screen after changing your settings. Auto tracking should be ON. Click the + (plus) sign in the lower right, then Create trip. The app will automatically detect your starting and stopping locations using your phone’s GPS. When you have arrived at your destination, open the Mileage app again.

Swipe left on the trip’s record to categorize it as business and right to mark it as personal. Enter the purpose of the trip if it is a business trip, and click Save. You will now need to turn off Auto-tracking and reverse the changes you made in your phone’s Settings (unless you normally leave any of them on). Remember, you can turn on the round-trip option if relevant.

We encourage you to discuss your tax preparer’s recommendation for the mileage deduction with your business to ensure that you are capturing all the tax deductions allowed.