Your Financials: How Statements Drive Better Business Decisions

Why Financial Statements Matter

Let’s say your bank account has money in it. That must mean business is good, right? Not necessarily. Financial statements go beyond your current balance to show how your business is really doing.

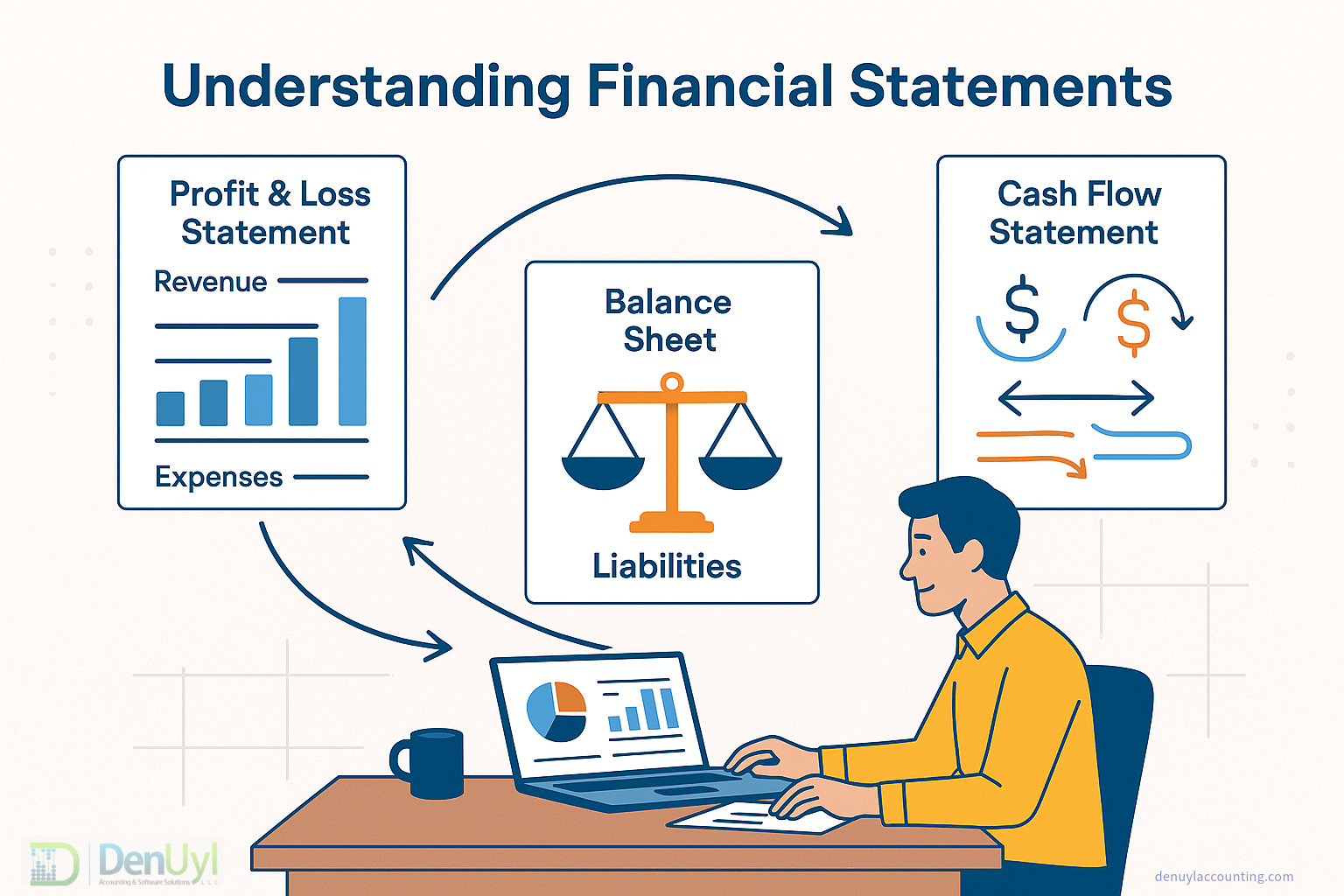

Understanding how your profit and loss statement, balance sheet, and cash flow statement work together helps you make better decisions, spot red flags early, and plan for what’s next.

In this article, we’ll walk through each report and show you how they all fit together to give a full view of your financial health.

The Profit & Loss Statement (P&L)

The P&L—also called the income statement—shows your income and expenses over a period of time, like a month, quarter, or year. It ends with your net profit or net loss.

Why it’s useful:

- Tracks how much money is coming in (revenue) and going out (expenses)

- Helps you compare performance month-over-month or year-over-year

- Shows if you’re profitable, breaking even, or losing money

A common misunderstanding: A positive net income doesn’t always mean you have available cash. That’s where the other two reports come in.

The Balance Sheet

The balance sheet is a snapshot of your business at a single point in time. It lists everything your business owns (assets), what it owes (liabilities), and the difference (equity).

Why it’s useful:

- Shows how financially stable your business is

- Helps lenders evaluate your financial position

- Reveals how much you’ve invested in the business versus how much you owe

Key formula: Assets = Liabilities + Equity

Tip: Review your balance sheet regularly to spot trends in debt or changes in equity.

The Cash Flow Statement

The cash flow statement shows how money moves in and out of your business. It’s divided into three parts:

- Operating activities (everyday income and expenses)

- Investing activities (buying equipment or property)

- Financing activities (loans and owner draws)

Why it’s useful:

- Tells you if you have enough cash to pay bills, invest, or save

- Highlights timing issues, like when payments come in late but bills are due now

Reminder: Cash flow isn’t the same as profit. You can have a profitable business that’s cash poor.

How They Work Together

These reports complement each other:

- The P&L shows if you’re making money

- The balance sheet shows your financial strength

- The cash flow statement shows your liquidity

Think of it this way:

- P&L = How fast you’re driving

- Balance Sheet = Your car’s dashboard

- Cash Flow = How much gas is in the tank

Looking at all three gives you the full picture. For example:

- Your P&L shows a profit, but your cash flow shows a shortage. That might mean you’re waiting on payments.

- Your balance sheet shows a growing loan balance. That could explain why cash is tight, even if sales are up.

Tips for Reviewing Your Financials

- Review monthly: Don’t wait for year-end.

- Use your accounting software: Most platforms, like QuickBooks, let you run and compare reports with just a few clicks. Explore your software’s reporting section to find these tools.

- Watch for trends: See how your numbers move from month to month. A single report might not show much, but patterns over time tell the real story.

- Ask questions: If something doesn’t make sense, ask your bookkeeper or accountant.

Final Thoughts

Understanding financial statements doesn’t have to be overwhelming. By checking all three—P&L, balance sheet, and cash flow—you’ll be in a much better position to manage your business confidently.

Need a hand reviewing your numbers? Let’s connect. We’ll make sense of the story your financials are telling.